Guide to Advance Settlement

What is Advance Settlement?

Advance Settlement is a feature on your Payment Gateway platform that allows you to instantly withdraw unsettled received payments, within a specified limit, to your registered bank account.

How to use Advance Settlement?

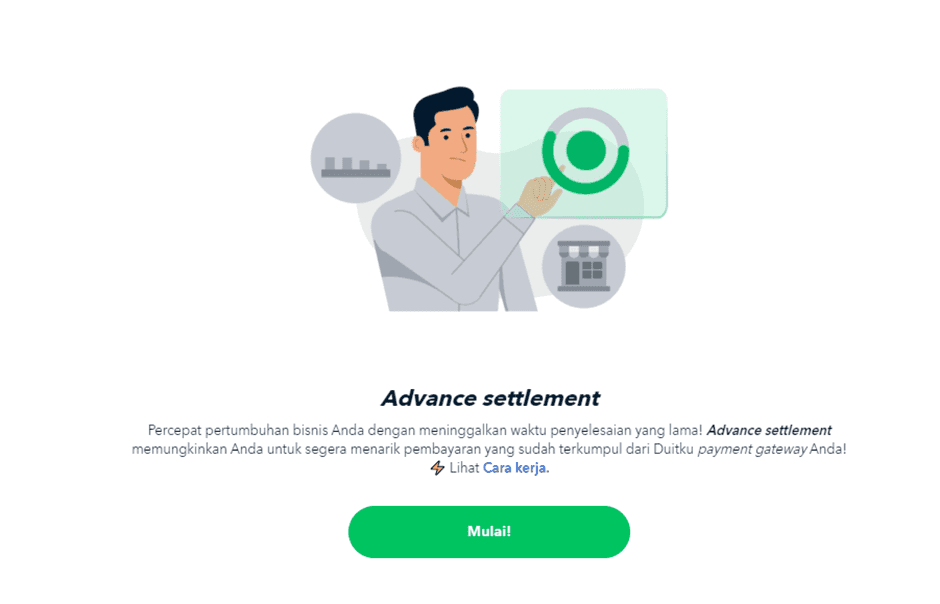

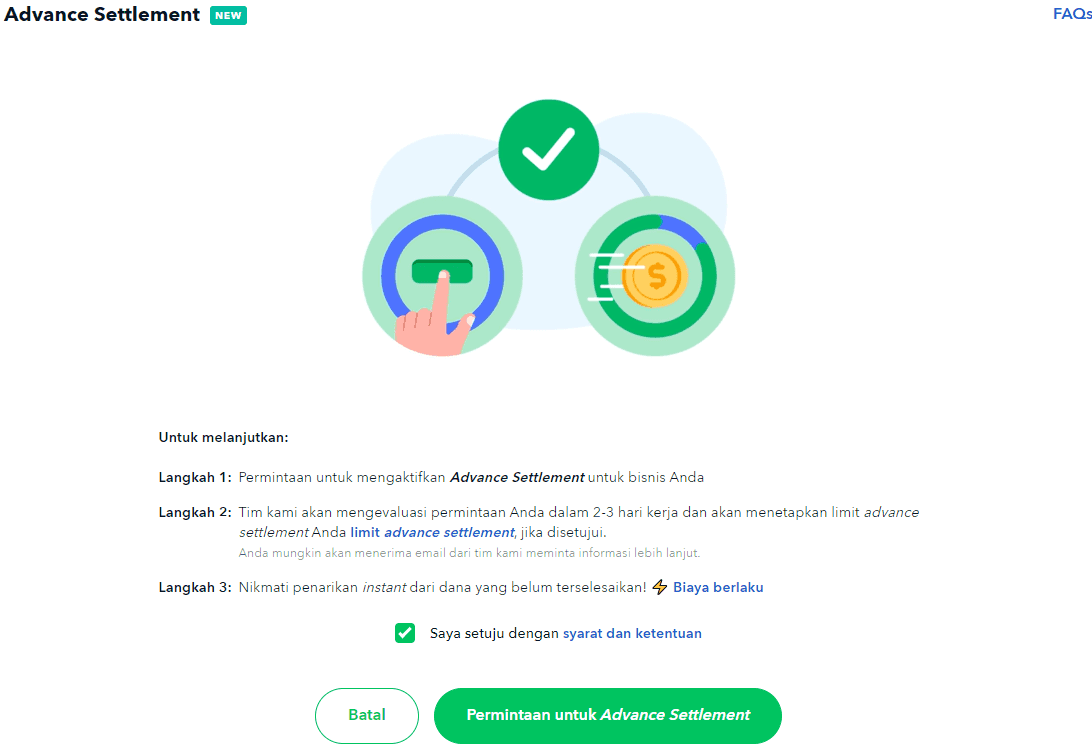

Activating your Advance Settlement

- Click on "Advance Settlement" in the left navigation bar.

- Click on "Get started".

- Next, you may agree to the terms and conditions, then click on Request for Advance settlement"

Your request will be processed within up to 3 working days. Please check periodically for updates on your request status.

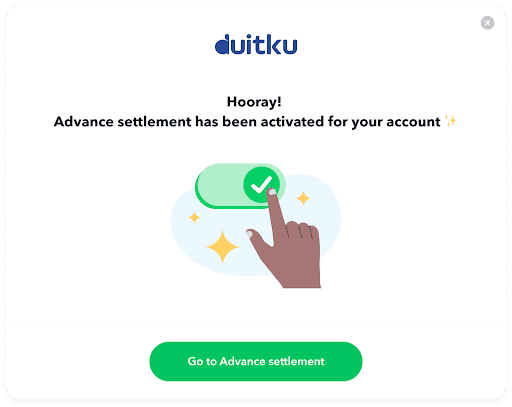

a. If approved, you will see a pop-up like the one below and you may use the Advance Settlement feature immediately.

b. If rejected, you will see a display like the one below. The rejection reason could include considerations such as transaction volume, business type, payment method, etc. You may raise another request after 3 months by contacting our teams.

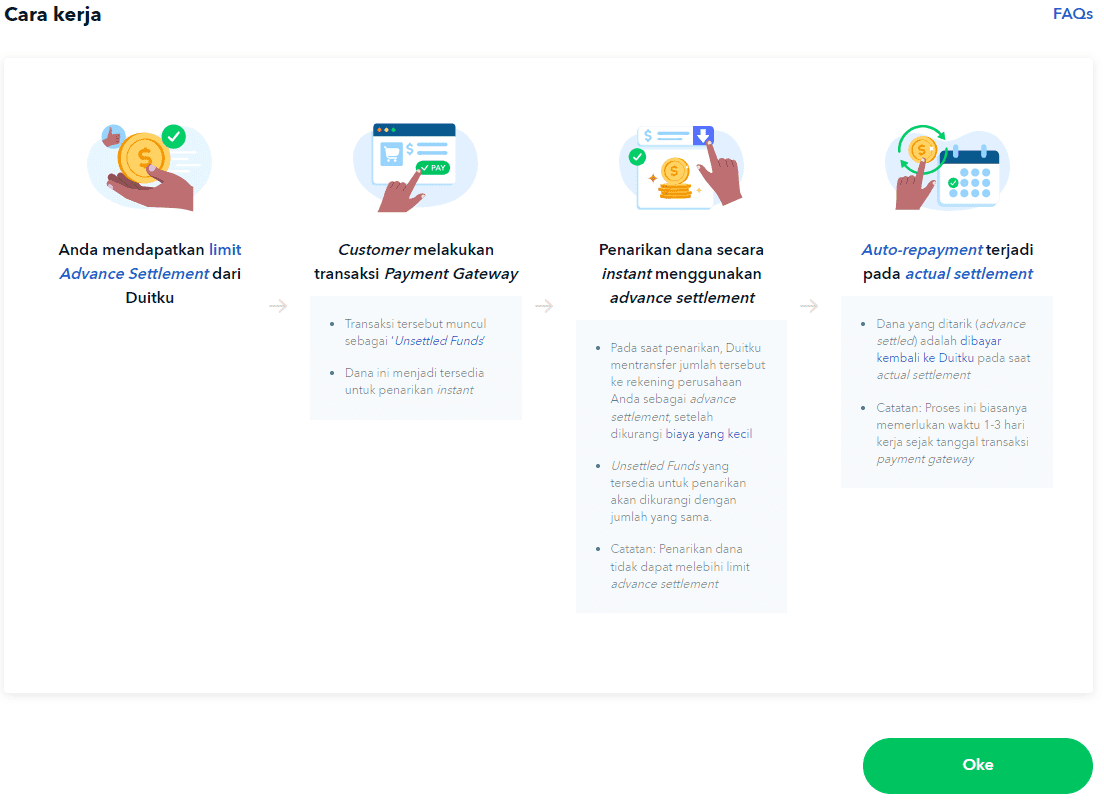

How Advance settlement works?

- Once the Advance Settlement feature is approved, your business will receive a certain amount of limit.

- If a customer has made a payment gateway transaction, then the amount of that transaction will be accumulated in the available unsettled funds, which becomes available for instant withdrawal.

- Your withdrawn amount will be deducted from the granted Advance Settlement limit. You can follow this instructions to withdraw your funds using the Advance Settlement feature.

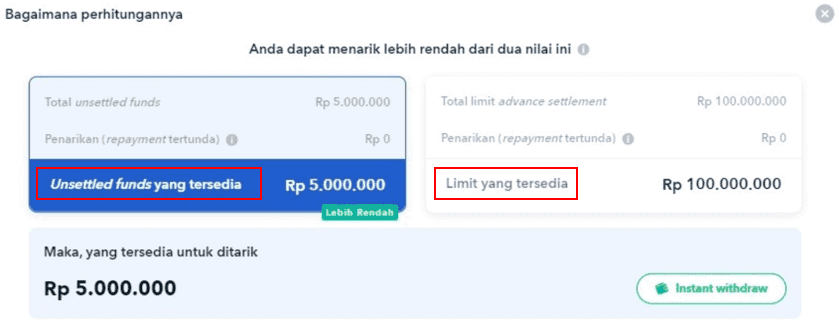

How many funds can I withdraw from my Advance Settlement?

The amount of funds that you can withdraw from your Advance Settlement will depend on the available unsettled funds that you have received in your Payment Gateway.

Example: You have received a payment of IDR 5M through your payment gateway. The IDR 5M will appear as available unsettled funds, meaning the payment has not yet been received in your Total Balance but is available for withdrawal using your Advance Settlement.

Your available limit represents the maximum amount you can withdraw in total.

Therefore, once you withdraw the funds, the amount will be deducted from your available limit.

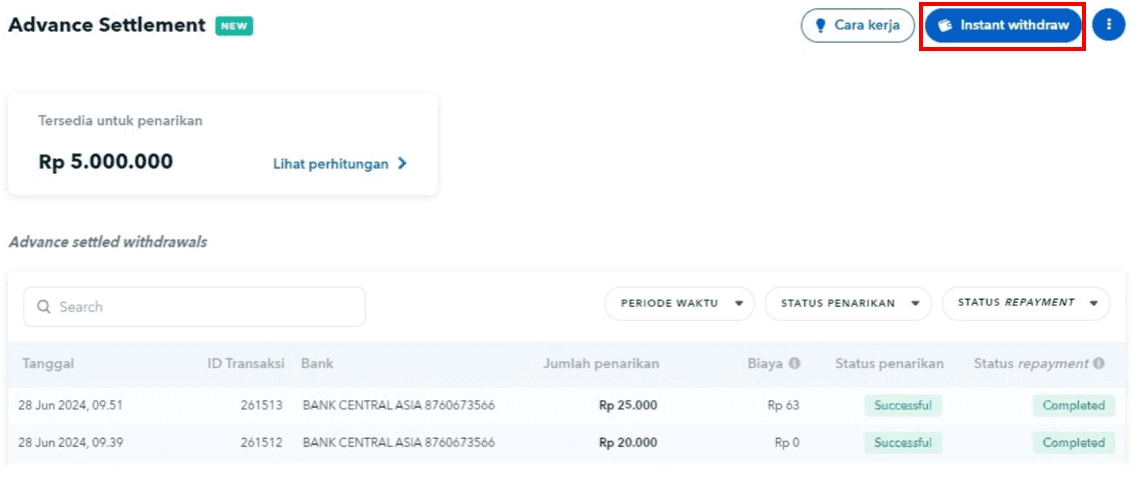

Withdrawing funds via Advance Settlement

Follow the steps by steps below to withdraw your funds using Advance Settlement:

- Click on "Advance Settlement" in the left navigation bar.

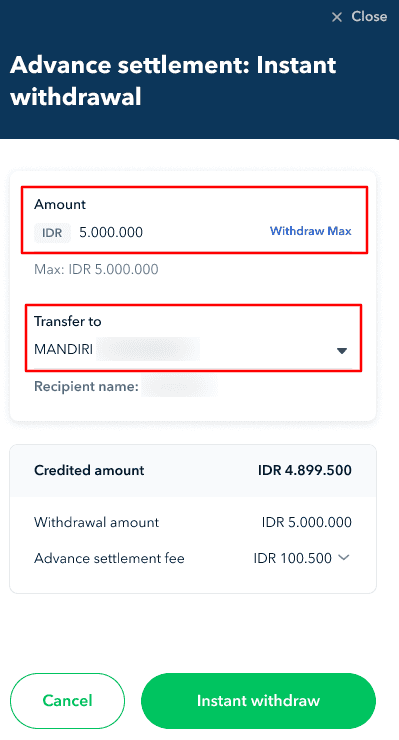

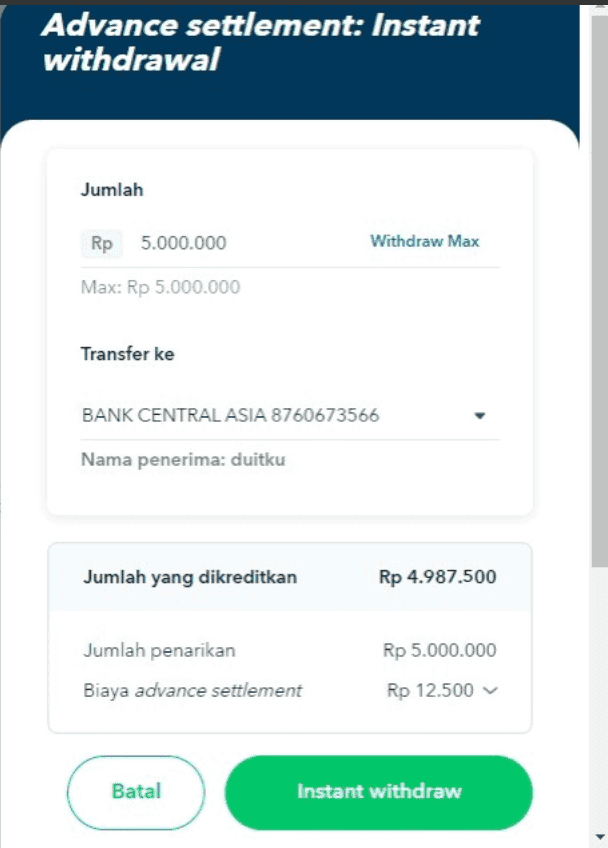

- Click on "Instant Withdraw".

- Next, fill in the amount you want to withdraw and choose the registered bank account you want to make the transfer to.

- Finally, click on "Instant withdraw" to send the transfer.

- Advance Settlement fee will be calculated based on the payment options used.

- For non-Permata banks, the minimum amount of withdrawal is IDR 200K, and the maximum amount is IDR 250 M.

Was the information on this page helpful?